|

Telephone: 023 8061 8891 Email: [email protected] |

|

BlogWe’re on our metal

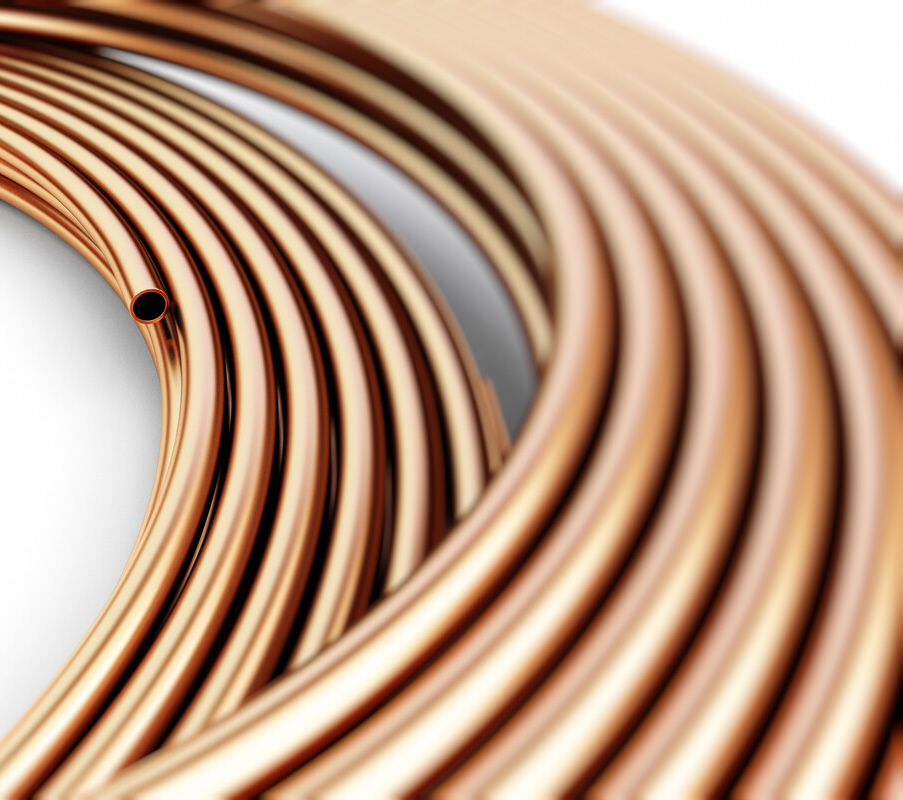

ADVANCED ALLOYSDoing exactly what it says on the copper |

|

|

|

Advanced Alloys Limited

Unit 17, Parham Drive

Boyatt Wood Industrial Estate

Eastleigh

Hampshire SO50 4NU

Telephone: 023 8061 8891

Fax: 023 8061 1481

No copyright infringement is intended on any sourced content or images used.

© 2026 Advanced Alloys Ltd.